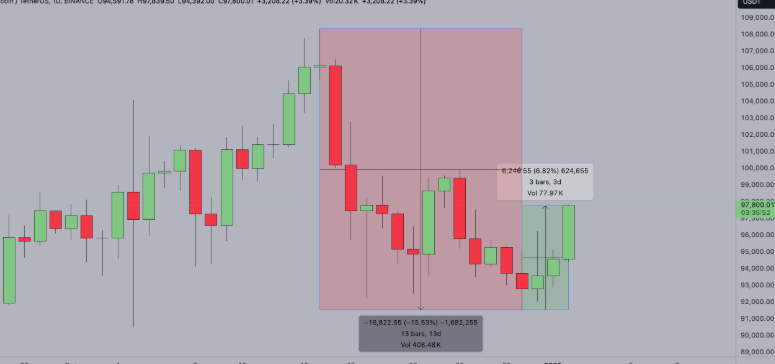

Is BTC Price on the Rise? Analyzing the Latest Trends

Bitcoin (BTC), the pioneering cryptocurrency, has continued to make waves in the global financial markets since its inception in 2009. Known for its volatility and dramatic price swings, Bitcoin remains a hot topic for investors, traders, and financial analysts alike. As of 2025, the big question is: Is BTC price on the rise? This article delves into the current trends, factors influencing its price movements, and expert predictions to help you stay informed.

1. Introduction to Bitcoin Price Movements

Btc price is one of the most closely watched metrics in the financial world. Unlike traditional stocks, Bitcoin does not have a central governing body controlling its price. Instead, it is influenced by several factors, including market demand, investor sentiment, regulatory news, and macroeconomic trends.

1.1 Bitcoin’s Price History: A Roller Coaster Journey

Bitcoin’s price history has been marked by significant volatility, which has made it both a risky and lucrative asset. From its early days, when it was worth just a few cents, to reaching an all-time high of nearly $69,000 in 2021, Bitcoin’s journey has been full of ups and downs. However, despite these fluctuations, Bitcoin has established itself as the leading cryptocurrency by market capitalization.

2. Factors Influencing Bitcoin Price in 2025

2.1 Global Economic Conditions

One of the primary drivers of Bitcoin’s price is the global economic environment. The rise of inflation, changes in interest rates, and global financial instability can significantly impact Bitcoin’s demand. For instance, in uncertain times, investors may turn to Bitcoin as a hedge against inflation or economic collapse.

Impact of Inflation and Economic Uncertainty

In 2025, inflationary pressures remain a key concern for many economies. As fiat currencies lose value, investors increasingly view Bitcoin as a store of value, much like gold. This trend may drive Bitcoin’s price higher, especially if traditional financial systems continue to face challenges.

2.2 Institutional Adoption of Bitcoin

In the last few years, institutional investors, including hedge funds, family offices, and even publicly traded companies, have started to show interest in Bitcoin. Their involvement brings more liquidity and stability to the market, which could lead to long-term price growth.

Bitcoin ETFs and Institutional Products

In 2025, several Bitcoin exchange-traded funds (ETFs) and Bitcoin futures products have been launched. These products give traditional investors easier access to Bitcoin, further legitimizing its role in the financial ecosystem. As more institutions move into the space, the price of Bitcoin may continue its upward trajectory.

2.3 Regulatory Developments

The regulatory landscape surrounding cryptocurrencies is constantly evolving. Governments around the world are working on frameworks to regulate Bitcoin and other cryptocurrencies. While regulatory clarity could be a positive development, overly restrictive regulations could stifle Bitcoin’s growth.

Impact of Global Regulation on BTC

In 2025, some countries have taken a more welcoming stance toward Bitcoin, while others have implemented stricter regulations. If major economies like the U.S. or the European Union adopt favorable policies, Bitcoin’s price could benefit. Conversely, if stricter regulations are introduced, it could dampen investor sentiment and cause price declines.

2.4 Technological Advancements and Upgrades

Bitcoin is constantly evolving to improve its scalability, security, and transaction speed. Updates such as the Taproot upgrade, which enhances Bitcoin’s functionality, could improve user experience and increase demand. Continued technological improvements will likely contribute to BTC’s price increases.

The Role of Bitcoin Halving Events

Bitcoin undergoes a halving event approximately every four years, which reduces the block reward miners receive. This decrease in the supply of new Bitcoin has historically led to price surges. The next halving event is expected in 2028, but discussions around potential impacts in 2025 could still influence market sentiment.

3. BTC Price Predictions for 2025

3.1 Expert Opinions on Bitcoin’s Future Price

Many financial analysts and experts have weighed in on Bitcoin’s price outlook for 2025. Some believe that Bitcoin could reach new all-time highs, while others caution that the volatility inherent in the cryptocurrency market could lead to sharp price corrections.

Bullish Predictions: A Bright Future for Bitcoin

Bullish analysts predict that Bitcoin’s price could soar to $100,000 or even $150,000 by the end of 2025. This is largely based on increasing institutional adoption, positive macroeconomic conditions, and growing global interest in decentralized finance (DeFi).

Bearish Predictions: The Risks of Volatility

On the other hand, some experts warn that Bitcoin’s volatility could result in significant price corrections. They argue that the market is still speculative, and without regulatory clarity or mass adoption, Bitcoin may not sustain its current price levels in the long run.

4. Bitcoin Market Sentiment in 2025

4.1 Retail Investor Influence

Retail investors continue to play a significant role in Bitcoin’s price movements. Social media trends, influencer endorsements, and retail enthusiasm have often contributed to rapid price spikes. In 2025, the influence of retail investors, especially via platforms like Twitter and Reddit, remains a powerful force.

Bitcoin as a Store of Value vs. Speculative Asset

The debate continues: Is Bitcoin a store of value like gold, or is it simply a speculative asset? As more individuals view Bitcoin as an alternative investment, its price could be driven higher. However, if the majority of Bitcoin investors are trading on short-term speculation, it may lead to volatile price swings.

5. The Role of Bitcoin Mining in Price Trends

5.1 Mining Difficulty and Price Correlation

The difficulty of mining Bitcoin affects the supply and, subsequently, its price. As the network becomes more secure, mining difficulty increases. This means that fewer miners can profitably mine Bitcoin unless its price rises. Consequently, there is a direct correlation between Bitcoin’s price and mining profitability.

6. How Bitcoin Price Can Impact the Crypto Ecosystem

6.1 Ripple Effect on Altcoins

Bitcoin’s price movements tend to have a ripple effect on the entire cryptocurrency market. When Bitcoin experiences significant price increases, other cryptocurrencies, or altcoins, often follow suit. Conversely, Bitcoin price corrections tend to drag the entire market down. This makes monitoring Bitcoin price and other potential altcoins price such as XLM to USD essential for staying ahead of market trends and making informed investment decisions.

Bitcoin Dominance in the Crypto Market

Bitcoin’s dominance in the market remains high, with its market capitalization constituting a significant percentage of the entire crypto market. This dominance means that Bitcoin’s price trends heavily influence the overall sentiment in the market.

7. Frequently Asked Questions (FAQs)

1. Is Bitcoin’s price expected to rise in 2025?

Yes, many experts predict that Bitcoin’s price will rise in 2025 due to increasing institutional adoption, favorable economic conditions, and technological advancements like the Taproot upgrade.

2. How do global economic conditions affect Bitcoin’s price?

Bitcoin’s price is often influenced by inflation, economic uncertainty, and global financial instability. In times of economic turbulence, more investors may turn to Bitcoin as a store of value, driving up its price.

3. What is the impact of Bitcoin halving on its price?

Bitcoin halving events reduce the reward for mining new Bitcoins, thereby reducing the rate of new supply entering the market. Historically, these events have led to price surges as demand remains high while supply growth slows.

4. Are there any risks associated with investing in Bitcoin?

Yes, Bitcoin is highly volatile, and its price can fluctuate dramatically due to market sentiment, regulatory news, and broader economic factors. It’s essential to approach Bitcoin investment with caution and only invest what you can afford to lose.

5. Can Bitcoin become a mainstream currency in the future?

While Bitcoin has made significant strides in adoption, its volatility and scalability issues still pose challenges. However, growing institutional support and technological upgrades could make Bitcoin more viable as a mainstream currency in the future.

6. Will government regulations impact Bitcoin’s price?

Yes, government regulations can have a significant impact on Bitcoin’s price. Positive regulatory developments may increase investor confidence and drive prices higher, while overly restrictive regulations could hinder growth.

8. Conclusion: The Future of Bitcoin Price

In 2025, Bitcoin continues to be a dynamic and exciting asset to watch. While its price has experienced significant volatility, the underlying trends point toward continued growth, especially with the support of institutional investors and technological advancements. However, potential risks such as regulatory changes and market corrections remain ever-present.

Investors should stay informed, keep a close eye on the latest trends, and approach Bitcoin investment with caution, keeping in mind the inherent risks and rewards.